What are the most common risks landlords face?

As a landlord, navigating the world of owning rental properties presents numerous opportunities for financial gain, but it also comes with inherent risks. Understanding and effectively managing these risks is crucial for protecting your investment and ensuring long-term success. Let’s explore the most common risks faced by landlords, actionable strategies to mitigate them and how Blue Crystal can help with landlord risk management.

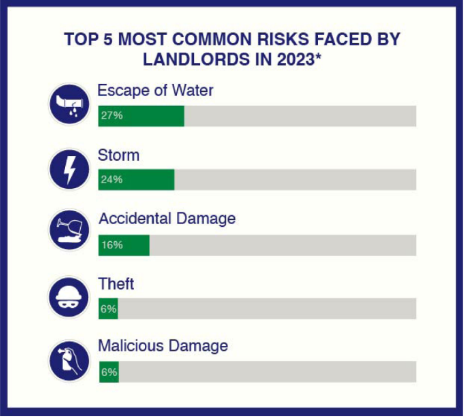

The top five most common risks faced by landlords

1. Escape of Water

Water damage is one of the most pervasive risks a landlord will encounter. Whether it’s a burst pipe, leaking appliance, or plumbing malfunction, water can cause extensive damage to your property and belongings. To prevent this risk, ensure regular maintenance of plumbing systems and appliances. Consider installing water leak detection devices and educating tenants about the importance of reporting leaks promptly. Find out more in our Water Escape blog post.

2. Storm Damage

Natural disasters such as storms, hurricanes, and floods pose significant risks to rental properties. Strong winds, heavy rainfall, and flying debris can cause damage to roofs, windows, and landscaping. To mitigate this risk, reinforce your property’s structural integrity, secure outdoor items, and invest in comprehensive insurance coverage that includes protection against storm damage. Find out more on How to handle an insurance claim in our blog.

3. Accidental Damage

Accidents happen, and rental properties are not immune to them. From unintentional spills to mishaps with appliances, accidental damage can lead to costly repairs and disruptions. Conduct thorough tenant screenings to identify responsible tenants and establish clear rental agreements outlining tenant responsibilities for property maintenance. Educate tenants about proper appliance usage and safety precautions to minimise the risk of accidents. Find out more about Tenant Insurance Cover in our blog.

4. Theft

Property theft is a common concern for landlords, particularly in urban areas or neighbourhoods with high crime rates. Burglaries and thefts can result in financial losses and property damage. Implement security measures such as robust locks, alarm systems, and motion-sensor lighting to deter potential thieves. Encourage tenants to secure their belongings and consider offering rental insurance options to protect against losses due to theft. There are several types of Landlord Insurances, learn more in our blog.

5. Malicious Damage

Unfortunately, some tenants may intentionally damage rental properties out of spite or negligence. Vandalism, graffiti, and deliberate destruction of property can incur significant costs for landlords. Conduct thorough background checks on prospective tenants and maintain open communication to address any signs of misconduct promptly. Enforce lease agreements that clearly outline tenant responsibilities and consequences for property damage. Looking for great tenants? Read our tips in The Good Tenant Guide.

Source: National Residential Landlords Association

Other risks that should be factored into your risk management plan

1. Fire Damage

From electrical faults to kitchen mishaps, fires can swiftly engulf a property, leading to extensive damage and endangering lives. Landlords must prioritise fire safety measures and carry out landlord fire risk assessments. Install smoke detectors and fire extinguishers in every rental unit, ensuring they are regularly maintained and functional. Read more about fire safety regulations in our blog on Fire, health and safety tips for landlords.

2. Non-Payment of Rent

Tenants failing to pay rent on time or defaulting on rental payments can lead to financial losses and cash flow disruptions for landlords. Read more in our blog on The best way to deal with rent arrears and Evicting a tenant and recovering the rent.

3. Tenant Disputes and Evictions

Disputes with tenants over lease terms, property maintenance, or behaviour issues can result in legal proceedings and eviction, leading to vacancies and potential property damage. Read more in our blog on How to avoid tenancy disputes.

4. Regulatory Compliance

Failure to comply with local housing regulations, building codes, and landlord-tenant laws can result in fines, penalties, and legal consequences for landlords. Read more in our section on Renting Laws in the UK.

5. Environmental Hazards

Environmental factors such as pollution, natural disasters, or hazardous materials can pose risks to property value and tenant health, requiring mitigation efforts by rental property owners. Read our blog on Asbestos in a rental property to find out more.

Strategies for Effective Landlord Risk Management

- Conduct Regular Inspections: Schedule regular property inspections to identify potential hazards and maintenance issues. Check for signs of water damage, structural weaknesses, and appliance malfunctions. Address any issues promptly to prevent them from escalating into costly repairs or liabilities.

- Invest in Preventive Maintenance: Proactive maintenance is key to preventing property damage and reducing risk. Schedule regular servicing of HVAC systems, plumbing, and electrical systems. Ensure appliances are in good working condition and provide tenants with instructions for proper usage and maintenance. Instal carbon monoxide alarms and fire safety equipment to protect against potential hazards.

- Secure Adequate Insurance Coverage: Protect your investment by securing comprehensive landlord insurance coverage. This should include property damage coverage, liability protection, and loss of rental income insurance. Review your insurance policy regularly to ensure it provides adequate coverage based on your property portfolio and potential risks.

- Establish Clear Rental Agreements: Draft detailed tenancy agreements that clearly outline the rights and responsibilities of both landlords and tenants. Include provisions related to property maintenance, rent payments, security deposits, and stipulate the right insurance requirements. Consult experts to ensure your lease agreements comply with tenant laws and regulations.

- Foster Positive Tenant Relationships: Building trust and open communication with your tenants can help mitigate risk and foster a sense of responsibility towards the property. Respond promptly to tenant inquiries and maintenance requests and address any concerns or disputes in a fair and transparent manner. By maintaining positive tenant relationships, you can reduce the likelihood of property damage and ensure compliance with lease agreements.

Blue Crystal Rental Property Risk Management

Landlord risk management is a multifaceted endeavour that requires vigilance, proactive measures, and effective communication. By identifying common risks such as water damage, storm damage, accidental damage, fire risks and malicious damage, landlords can implement strategies to mitigate these risks and protect their rental properties.

At Blue Crystal Property Management, we understand the challenges landlords face in managing their rental properties and navigating the complexities of risk management. Our team of experienced professionals is dedicated to providing comprehensive solutions tailored to your specific needs for maximum risk reduction.

From conducting regular inspections, screening potential tenants, carrying out preventive maintenance to advising adequate insurance coverage and fostering positive tenant relationships, proactive risk management can safeguard your investment and ensure the long-term success of your rental property business.

At Blue Crystal Property Management, we understand the complexities of landlord risk management and are committed to providing comprehensive property management solutions tailored to your needs. Contact us today to learn more about how we can help you mitigate risk and maximise the profitability of your rental properties.

Book your 30-minute complimentary property consultation by phone: 020 8994 7327 or email: pm@bluecrystallondon.co.uk.